We get all sorts of fantastic questions from brilliant people over here at Alternative CPA & Consulting (or, as we affectionately call ourselves, “AltCPA”). One of the most-asked questions we get from our clients and future clients is, “Do I have to pay sales tax on … ?”

The most common answer is, “Maybe, it depends…” I know that’s probably not the answer anyone is hoping for, so let’s go into this a bit further. I believe it’s helpful to have a firm understanding of how sales tax works. I’m in Idaho (where freedom has the overwatch position), so I’m going to use Idaho as an example. Just bear in mind that things may be slightly different where you live, but no worries: we do sales tax compliance work throughout the United States. Someone in our office can absolutely help YOU!! 😊

Products vs. Services

In Idaho sales tax is due only when a retail product (even an intangible product like software) is sold. There is no sales tax on services. Let me give you an example: teaching is a service, not a product, so there is no sales tax on teaching in Idaho.

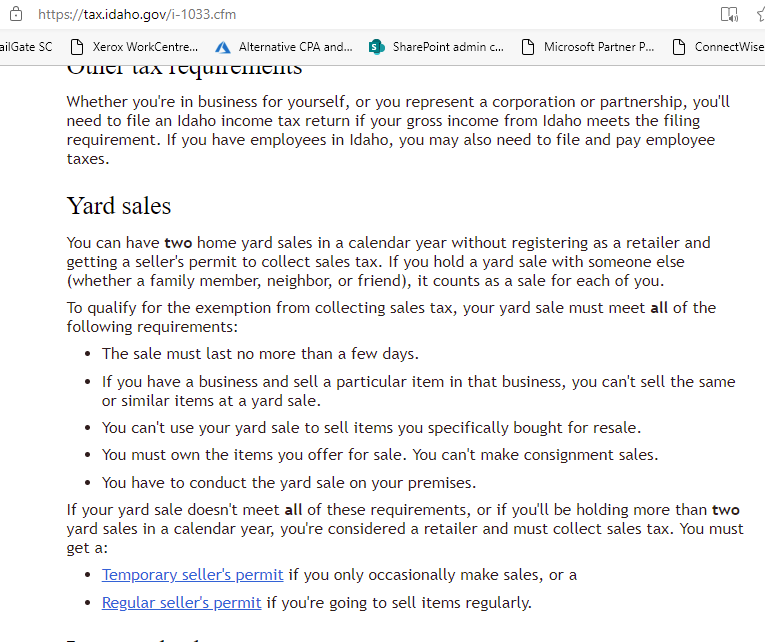

On the other hand, everyone in the state must pay sales tax when they sell a product: technically you’re supposed to remit sales tax if you have more than two yard sales per year! Check this craziness out:

I guess they “let you” have two though, right? 😳

Our Perspective

“Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.”

US Supreme Court Justice Learned Hand, Helvering v. Gregory, 69 F.2d 809 (2d Cir. 1934)

We help a lot of people with a lot of tax issues. In fact, it’s pretty incredible how much money we’ve saved out clients (that number is comfortably in the millions, he humbly writes). How are we so successful at what we do?

We make one thing clear from the outset: we are your advocate. See that quote from Judge Hand up there? We share his perspective: you don’t owe one penny more in taxes than the government can prove you owe. It’s our job to defend your interests, not to make sure “you’re paying at least your fair share”. Your “fair share” is the absolute minimum amount of tax you can pay under the law. Anything else would be immoral and unethical.

Since we’re your advocate, you get to tell us every single thing with complete honesty and, unlike the government, anything you say can and will be used to reduce your tax owed. This allows us to uncover every opportunity, most of which you don’t know exist!

Let’s get back to sales tax…

No Good Deed…

So you don’t need to remit sales tax for teaching students. Any reasonable person would think you wouldn’t need to get a sales tax permit for a school, right? But… let me give you an example of when a school would need to remit sales tax: fundraising activities. You know that “crazy yard sale example” I shared above? Well if you’re a school – even a nonprofit – you must collect and remit sales tax on a rummage sale or yard sale. The exemption of two per year only applies to private households!

So, if you’re a charity sacrificing your time and talents to do a good work for the benefit of your community, please don’t forget that the state is not as charitable: they will demand their pound of flesh under penalty of law!

In summary, you know your business better than I do: if you’re selling something other than a service (even if it’s a “thing” you can’t touch), then sales tax is a yes. If you’re just enlightening young minds into the greatness of what it means to be a rational, caring human being, then the state can’t touch it (at least not with sales tax)!!

Clear as mud?

How Can I Know For Sure?

I know someone else who will know if you owe sales tax better than either one of us!!! It’s our amazing STAFF!! Not only are they awesome people to hang out with, but they love learning about your business as if we were your “non-equity partners”. They have the knowledge and the skill and, once you fill them in on your business, they will be the true experts, the go-to-folks, the geniuses in your back pocket: you will get to exploit your greatness in this world and leave the headache of sales tax to weird people like us who (masochistically?) enjoy that sort of thing. Don’t judge!!

We’ll make this easy, and it’s more affordable than you think! Are you really saving money, or are you just standing in the way of your success? 😉